Keeping your financial information secure should be a top priority whenever conducting transactions online or in person. Unfortunately, scammers are always devising new ways to steal people’s banking details.

We strive to educate the public about basic internet safety and security best practices. In this post, I’ll share five crucial tips everyone with a bank account must follow to protect themselves from fraud.

- Regularly Reconcile Bank Statements

One of the best defenses is simply being aware of your account activity. we recommend visiting your bank at least once every 2-3 months to obtain a statement that lists all debits and credits during that period. Taking the time to reconcile these statements yourself is important for spotting any unauthorized charges early. - Enable Email/SMS Alerts

Don’t make the mistake of thinking routine service fees justify ignoring email or SMS alerts from your bank. These alerts about deposits, withdrawals and transfers provide a crucial

layer of oversight. Ensure your bank has your correct contact information on file to receive notifications.

- Be Cautious With Bank Cards

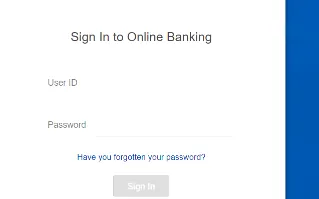

Limit how often cards are left unattended at home or work where others might see sensitive details. It’s safest to store cards separately from your wallet when not in use. Never lend out cards or provide PINs to anyone else under any circumstances. - Log Out of Online Banking

Completing a transfer on your bank’s website or app? Always remember to log out of your account afterward for maximum security. Leaving yourself logged in opens doors for potential hackers if your device is compromised. - Avoid Public Devices

When possible, conduct banking activities using only your personal, trusted devices. Public computers in internet cafes are risky choices for logging into funds accounts due to malware and keylogging threats. Use caution if a mobile money transfer must be made away from your approved devices.

By practicing these simple tips, you take control and dramatically reduce chances of becoming a fraud victim. As always, if any one has additional banking safety questions, please feel free to ask – educating you is my top priority here on the Dannycom Channel. Staying vigilant can help keep your hard-earned money safe for years to come.